End of Year Close Out Procedure for Tax

At the “key prompt”,

For Tax select “TAX” ---> “TAX PROOFING” ---> “DUPLICAT MAINT” --->

“ END TAX YEAR” ---> “ End Tax Year”

For Utility, select “UT TAX” ---> “Util PROOFING” ---> “DUPLICAT MAINT” --->

“ END TAX YEAR” ---> “ End Tax Year”

For Special District, select “S” from the login menu “TAX” ---> “PROOFING” ---> “DUPLICAT MAINT” ---> “ END TAX YEAR” ---> “ End Tax Year”

NO ONE SHOULD BE USING THE TAX SYSTEM DURING THE CLOSE OUT PROCEDURE !!!!!!!!!!!!!

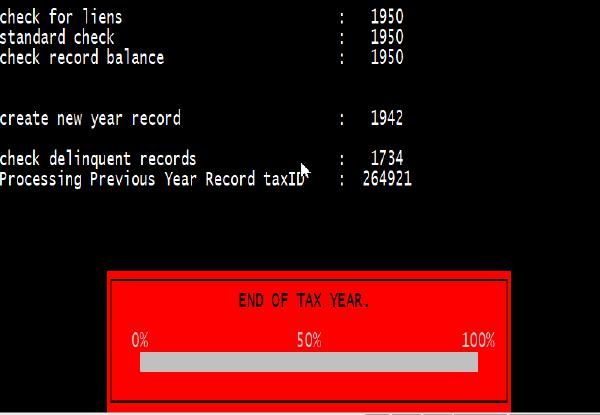

The end of year process will automatically adjust small balances overpaid and delinquent, transfer 2018 taxes to Township liens, create over payment records and create the end of year penalty for tax records.

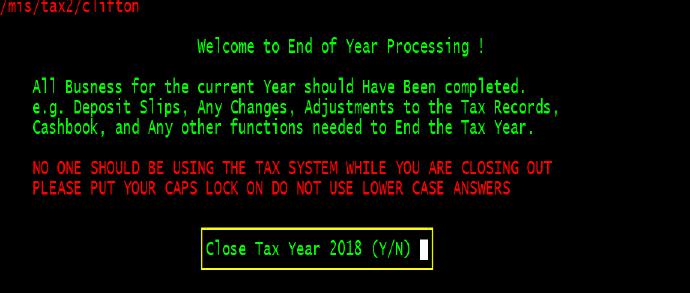

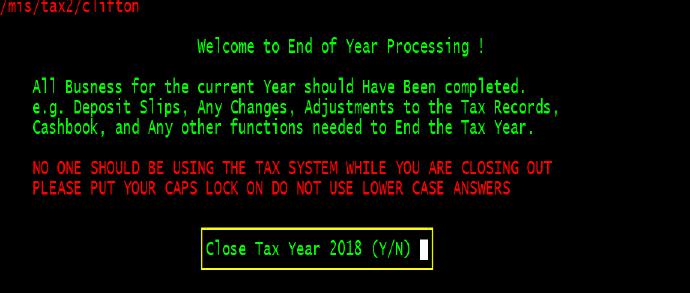

A screen similar to figure 1 will appear, put your “caps lock” key on.

Figure 1

Select “Y” to start the close out procedure or “N” to exit

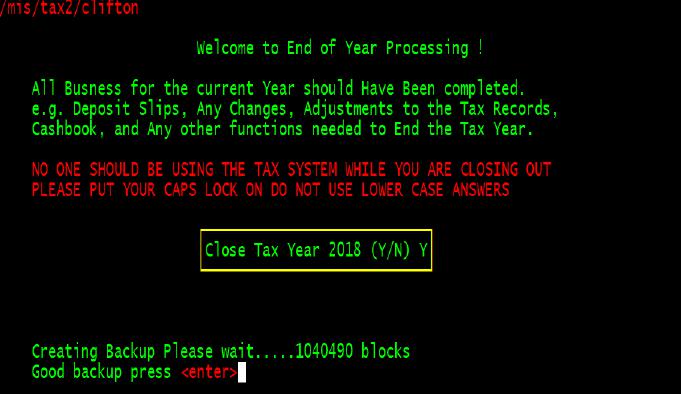

First the tax system will create a backup of your current data, then archive the data in to a folder called “2018” after the small balance adjustments. This “2018” folder is for audit purposes and should not be altered in any way.

The number of “blocks” will be displayed if the system was able to create the backup, similar to figure 2.

Figure 2

Next press <enter> to proceed

You will now be prompted for your tax password, only the CTC's password will work.

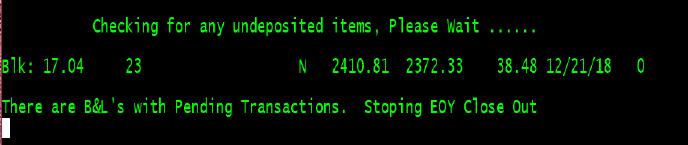

If there are any open deposits the system (see figure 3) will give you and error message and you will need to run a deposit for any open transactions and start this process over, there will be no end of year processing done just a back up file will be created.

Figure

3

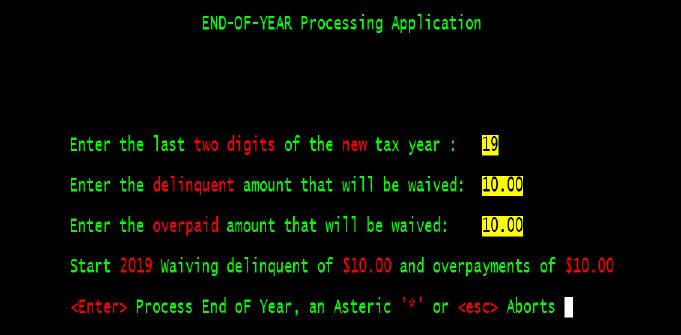

Next the tax system will ask for a two digit new year, the delinquent amount to be waived and the overpaid amount to be waived, see Figure 4.

Figure 4

After pressing enter the following output will be displayed.

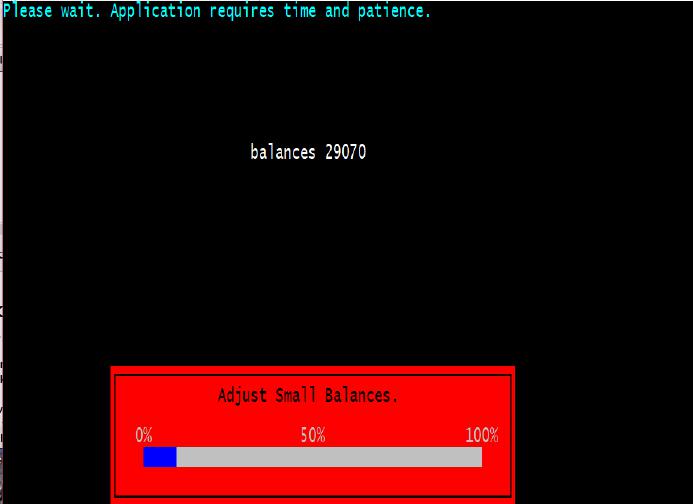

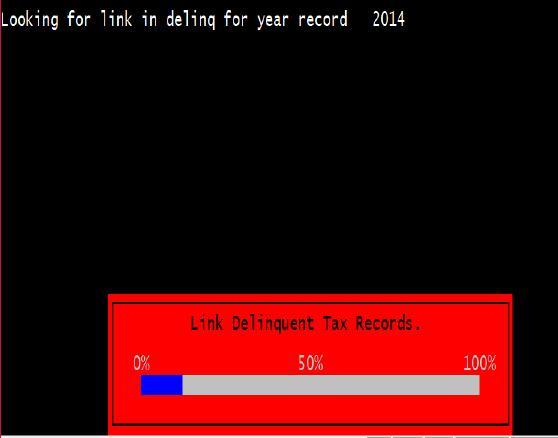

Next the system will create the prior year “Archive”

Press <enter> to continue with the close out.

If there are no error messages and the “Key Prompt” returns, you are finished

Don't forget to change the date to Jan 1, 2019 before you start posting.