Printing Tax Bills

How to Print Tax Bills

You do not need to have your duplicate to print final tax bills, what you do need is your certified levy from the county tax board see below.

Under monthly reports run a page summary (F5).

The “NET VALUE USED TO COMPUTE TAX RATE” must equal the total assessment from your page summary, this means your assessed values are equal to the assessed values used to compute the tax levy.

In

this case the assessed values for Califon is 145,528,008.00 this

number times your rate is the total to be billed for the year. If

these numbers do not match stop and call Municipal Software.

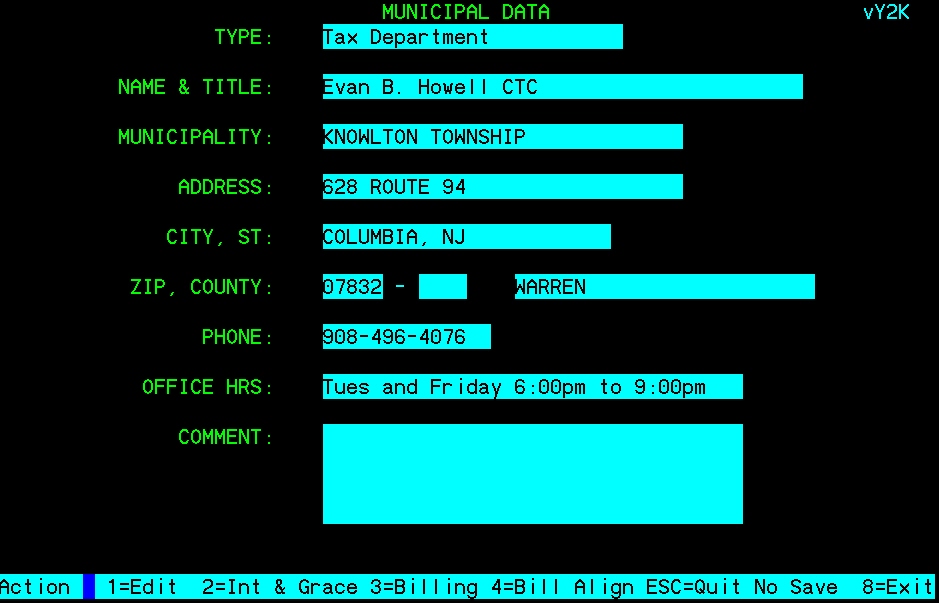

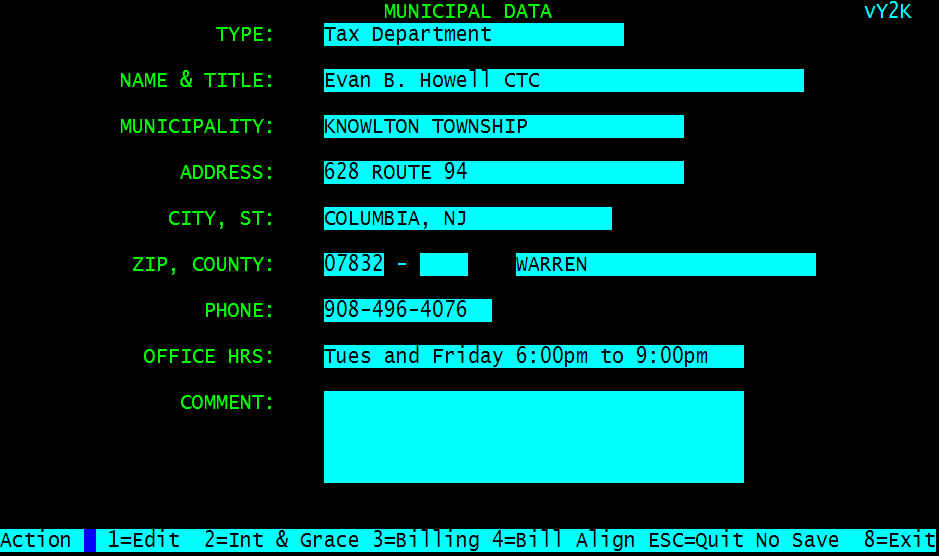

If your levy is in proof select “Municipal Info”, enter your password, you should see the following screen

Select “3=Billing”

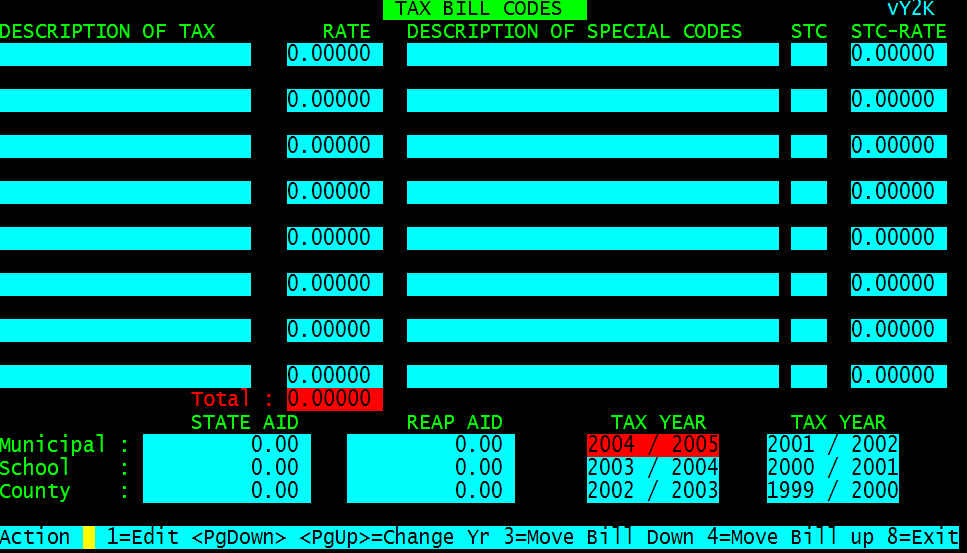

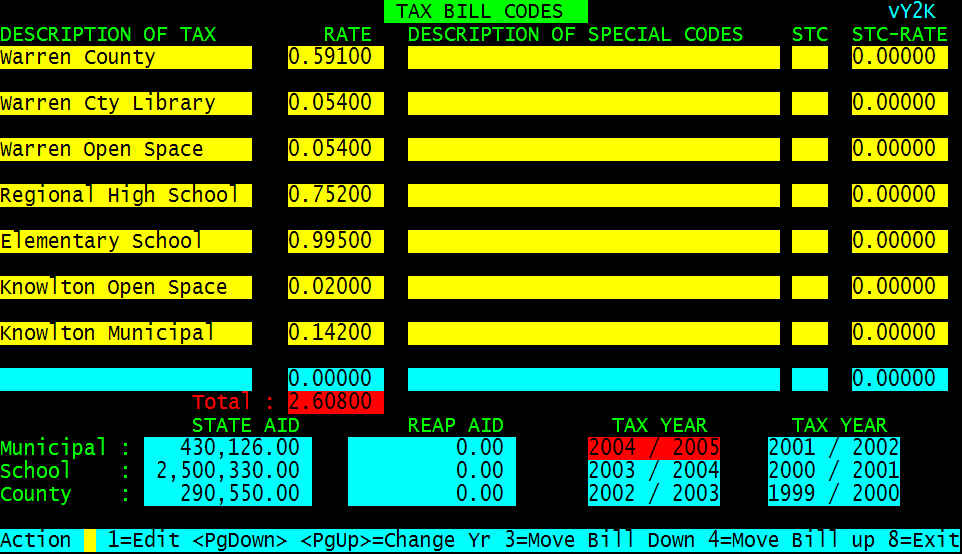

Select “1=Edit” and type in the description that you would like to have printed on the bill, then enter the tax rate, pressing enter for each field. After all the rates have been entered, put in the state aid figures, pressing enter for each field. When finished press the <ESC> key and the rate will be totaled.

Please make sure the rate matches the county exactly, some county boards round the rate for you, others do not. It is your responsibility to make sure the rates are correct.

Select “8=Exit” this will save the tax rate.

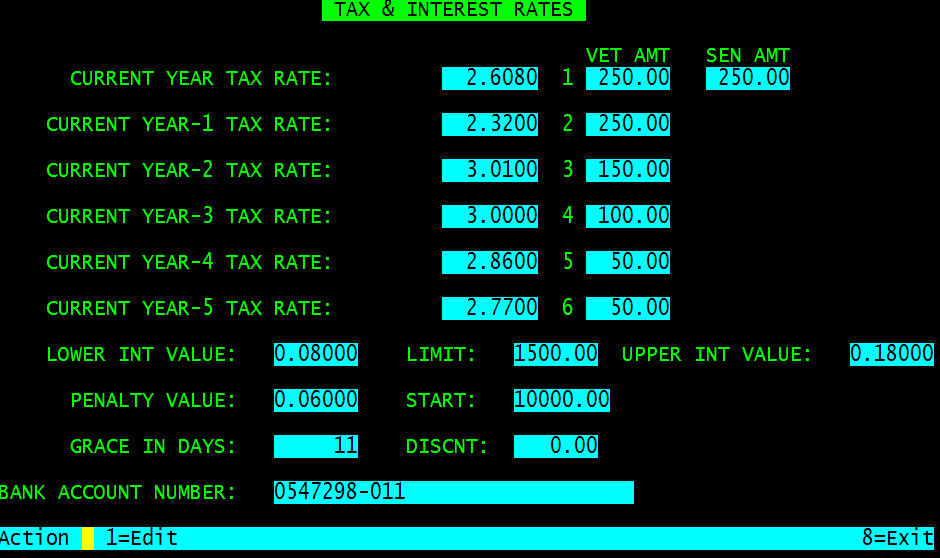

Select

“2=Int & Grace” and check senior citizen, vet

amounts, and tax rates.

When all information is verified select “8=Exit”, then “8=Exit” again

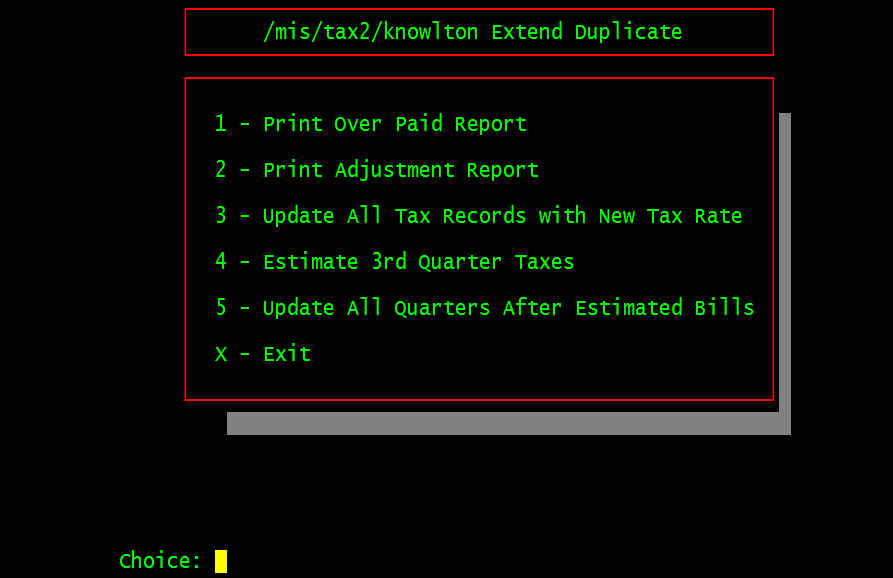

At the Key prompt select “TAX PROOFING”, “DUPLICAT MAINT”, “Calculate Taxes”

Select

“1 – Print Over Paid Report”. This will show what

credits (over payments) will be applied to the 3rd and/or

4th quarters.

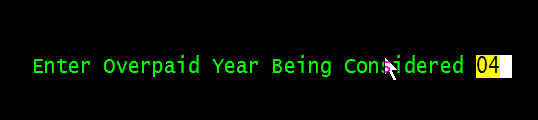

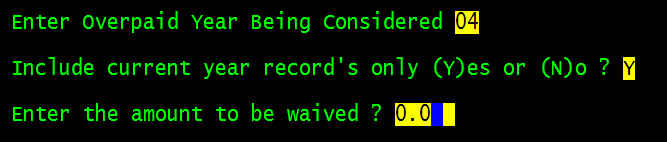

Select the printer, then enter the current year of the overpaid/billed

enter “Y” for current year over paid only and the amount to be waived.

Keep this report so you know how the bills were adjusted.

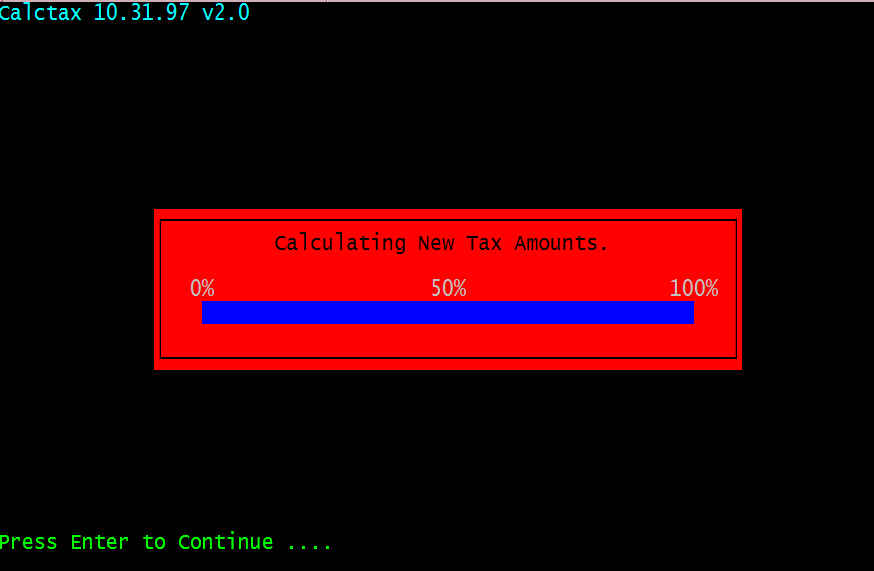

Select “3 - Update All Tax Records with New Tax Rate” When all the tax records have been updated you will see the following

Press Enter and all tax records will be updated with the new tax rate. Select “ X – Exit” and “RETURN 1 LEVEL”,

At this point enter your appeals, allows or disallows.

Select “2 - Print Adjustment Report”, keep this report as it shows all the Appeals, Senior and Vet adjustments made to the tax bills.

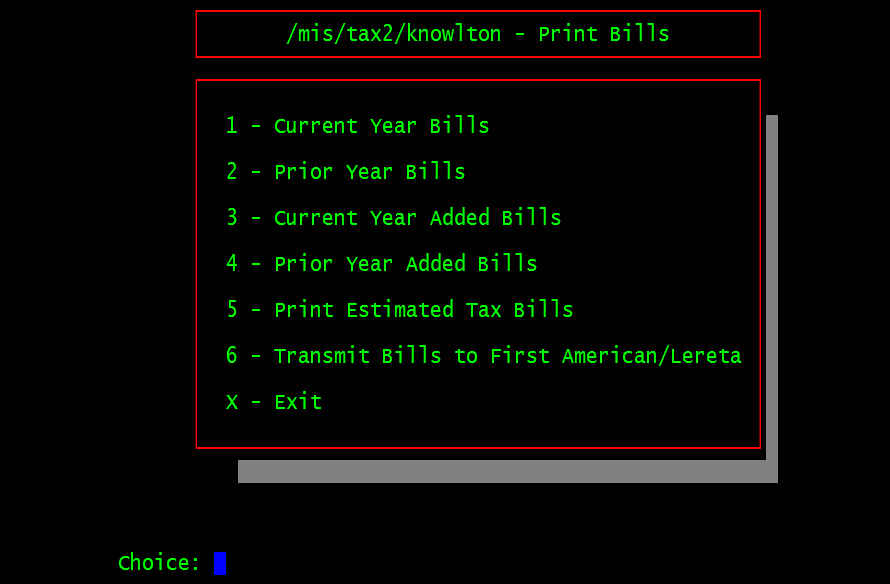

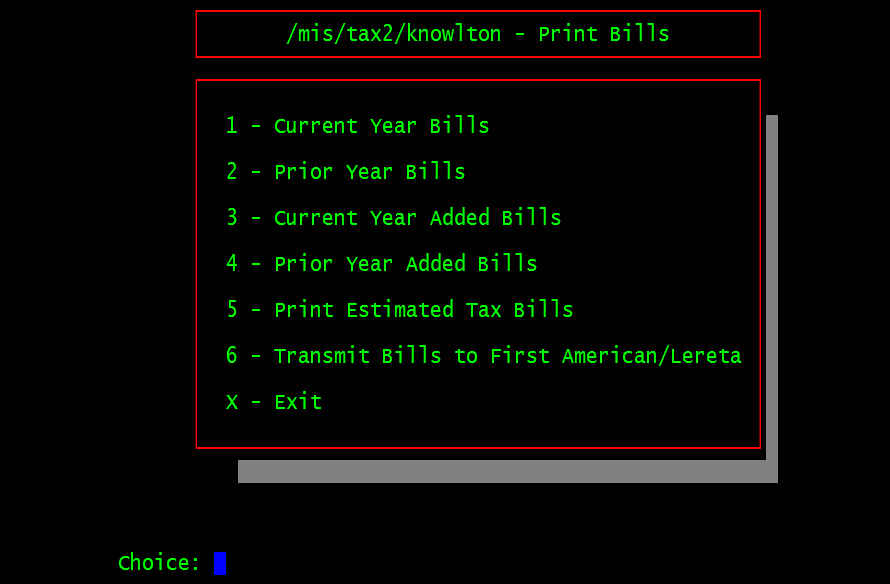

Select “Print Tax Bills” from the key prompt, then “1 - Current Year Bills”, then select the printer.

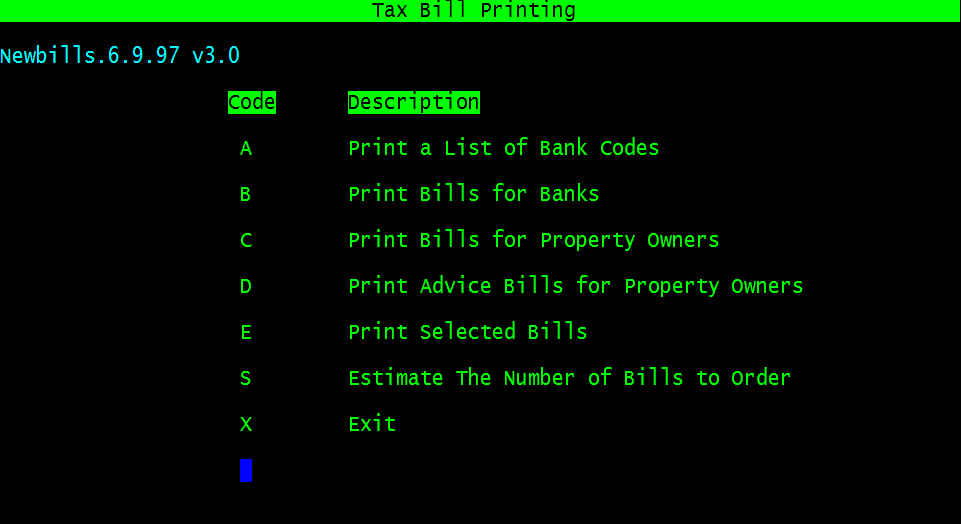

Select “E Print Selected Bills” and test-print a duplicate bill. If the information is not lined up in the proper locations, call Municipal Software for help in correcting this.

Print the Property Owners, then the Bank copies (excluding First American,Wellsfargo and Lereta), and Advice Copies.

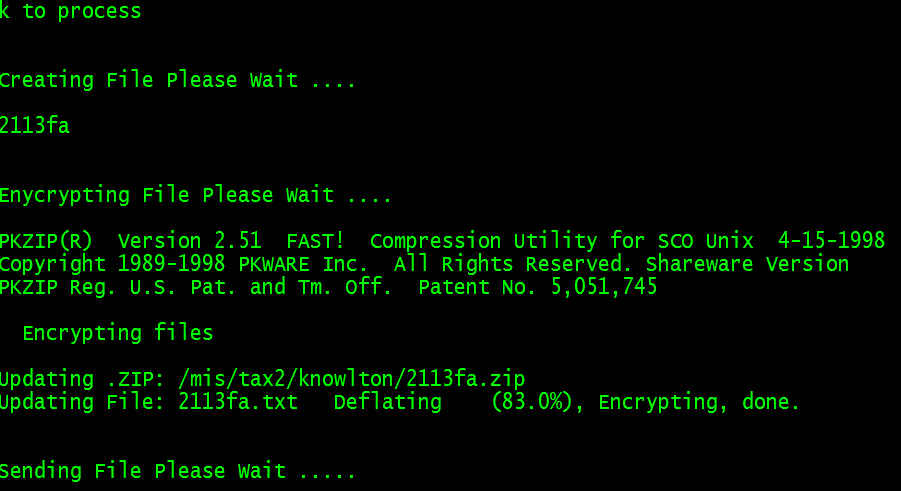

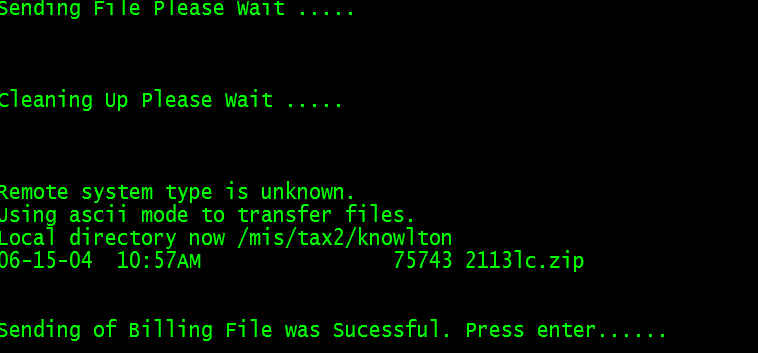

Select “ 6 - Transmit Bills to First American, Wellsfaro and Lereta”.

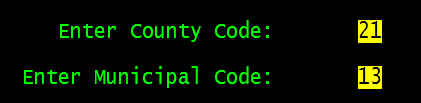

Enter your County and Municipal Code (you can find it in the duplicate if you don't know it)

You should see “Sending of Billing File was Successful” (from both First American and then for Lereta) if not please call Municipal Software

That's it you are Finished.

Except for the stuffing part.....